Introduction

When it comes to saving for retirement, many people use a Traditional IRA (Individual Retirement Account). A Traditional IRA lets you set money aside for your future while lowering the taxes you pay today. This is called a tax saving investment, because it not only helps you build retirement savings but can also reduce your current tax bill.

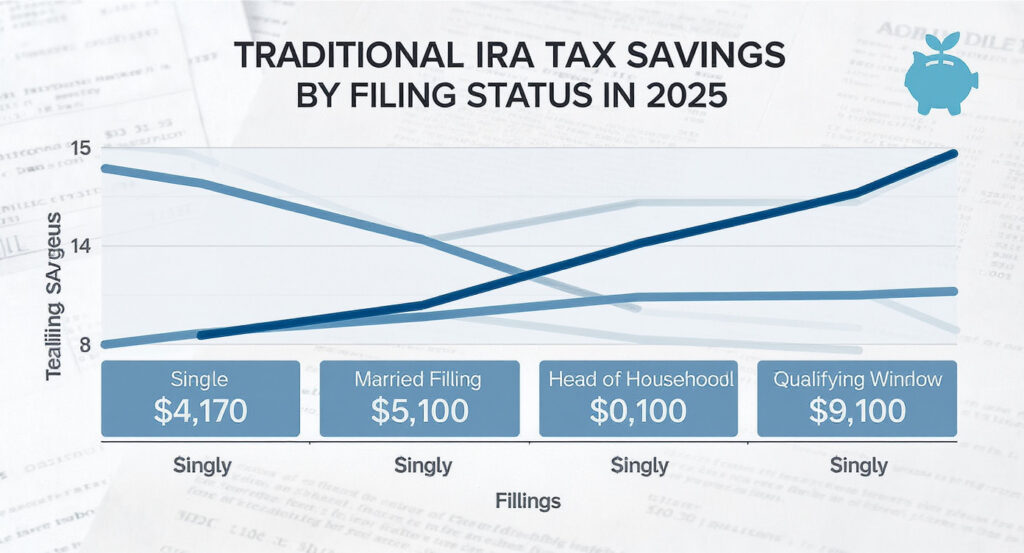

But here’s the important part: the tax savings from a Traditional IRA don’t work the same for everyone. Your filing status—whether you are single, married filing jointly, or married filing separately—affects how much you can save. That’s why understanding the differences between these filing statuses is so important.

In this article, we’ll explain:

- What a Traditional IRA is and why it’s considered a tax saving investment.

- How the tax savings work for different filing statuses.

- What single, joint, and married-separate taxpayers should know before making contributions.

- Tips to maximize your tax savings in 2025.

What Is a Traditional IRA and Why Is It a Tax Saving Investment?

A Traditional IRA is a type of retirement account that allows you to put in money before taxes. This means the money you contribute can be deducted from your taxable income. For example, if you earn $60,000 in a year and put $6,000 into a Traditional IRA, the government will only tax you on $54,000. That lowers your tax bill for the year.

This is why a Traditional IRA is called a tax saving investment. You’re investing for retirement while also cutting down your taxable income right now. Later, when you retire, you will pay taxes on the money you take out. But usually, people are in a lower tax bracket when they retire, so they pay less tax overall.

The maximum amount you can contribute in 2025 is $7,000 if you are under age 50, or $8,000 if you are age 50 or older. These numbers apply no matter your filing status. But the real difference comes when figuring out if your contributions are fully deductible.

Do Single, Joint, or Married-Separate Taxpayers Get Different Tax Savings Benefits?

1. Single Filers

For single taxpayers, Traditional IRA tax savings are straightforward. If you don’t have a retirement plan through your job, you can usually deduct the full amount of your contribution. That means all your Traditional IRA savings count as a tax saving investment.

However, if you do have a workplace retirement plan, like a 401(k), the rules change. The government sets income limits. If your income is below a certain level, you can still deduct the full contribution. If it’s higher, your deduction might be reduced, or “phased out.”

For example, in 2025, single filers covered by a workplace retirement plan can take the full deduction if their income is under a certain amount (the IRS updates these numbers each year). Above that, the tax savings shrink.

2. Married Filing Jointly

Married couples who file jointly usually have more flexibility. They can both contribute to their own Traditional IRAs, doubling their retirement savings power. Like single filers, their tax saving investment deductions depend on whether they have a workplace retirement plan.

The phase-out income limits for married joint filers are usually higher than for singles. This means couples often get to deduct more of their contributions before hitting the income cutoff. For example, if one spouse has a retirement plan at work and the other does not, the spouse without the plan can often deduct the full amount no matter how much the couple earns (within certain limits).

This makes filing jointly one of the best ways to maximize Traditional IRA tax savings.

3. Married Filing Separately

This is the most limited category. If you’re married but file your taxes separately, your ability to deduct Traditional IRA contributions is much smaller. In fact, the income limits for this status are very low.

Even if only one spouse has a workplace retirement plan, the phase-out for deductions starts almost immediately for those filing separately. This makes it very hard for married-separate filers to take full advantage of the Traditional IRA as a tax saving investment.

For this reason, many couples choose to file jointly if they want to maximize their Traditional IRA tax savings.

Key Example Scenarios

To make things easier, let’s look at three examples of how filing status affects Traditional IRA tax savings.

- Anna (Single): Anna earns $50,000 a year and doesn’t have a workplace retirement plan. She puts $6,000 into her Traditional IRA. Because she’s single and under the income limit, she gets to deduct the full $6,000. Her taxable income drops to $44,000.

- Mark and Lisa (Married Filing Jointly): Mark earns $70,000, and Lisa earns $50,000. Mark has a 401(k) at work, but Lisa doesn’t. They both contribute $6,000 to their Traditional IRAs. Even though Mark’s deduction may be reduced because of his 401(k), Lisa can deduct the full $6,000. Filing jointly helps them save more.

- Tom and Sarah (Married Filing Separately): Tom earns $60,000 and has a retirement plan at work. Sarah earns $30,000 and does not. They both file separately. Because of their filing status, their ability to deduct contributions is extremely limited. Most of their contributions may not be deductible at all.

These examples show how much filing status matters when it comes to making the most of a tax saving investment like a Traditional IRA.

Tips for Maximizing Traditional IRA Tax Savings in 2025

- Know Your Income Limits

The IRS updates income limits each year. Always check the new numbers for 2025 to see if you qualify for a full deduction. - Consider Your Filing Status

If you’re married, filing jointly usually gives you the best chance to take advantage of Traditional IRA tax savings. Filing separately often limits deductions. - Use “Spousal IRAs”

Even if one spouse doesn’t work, they can still contribute to a Traditional IRA if the couple files jointly and the working spouse has enough income. This doubles the retirement savings potential. - Balance with Other Retirement Plans

If you already have a 401(k) or similar plan at work, keep in mind how it affects your Traditional IRA deductions. Sometimes, it makes sense to put more into your 401(k) if your IRA deduction is limited. - Think About the Future

Remember, Traditional IRA contributions lower your taxes today, but you’ll pay taxes when you withdraw the money in retirement. Plan ahead by thinking about what your income and tax rate might be when you stop working.

Conclusion

A Traditional IRA is one of the most effective tax saving investments for people who want to lower their tax bills while building retirement savings. But the benefits depend heavily on your filing status.

- Single taxpayers often have straightforward rules and can deduct contributions more easily.

- Married couples filing jointly usually get the best tax savings, especially if only one spouse has a retirement plan at work.

- Married-separate filers face the most restrictions and may find that Traditional IRA tax savings are very limited.

By understanding these differences, taxpayers can make better choices in 2025. Choosing the right filing status, knowing the income limits, and planning contributions carefully can make a big difference in how much you save on taxes today—and how much you have in retirement tomorrow.