When it comes to saving for retirement, many people choose a 401(k) plan. Two of the most popular types of 401(k) plans are the Roth 401(k) and the Traditional 401(k). Each of these retirement accounts comes with its own set of benefits, especially when it comes to taxes. Understanding the differences in the tax benefits of a Roth 401(k) vs. a Traditional 401(k) is crucial in helping you decide which one is best for your financial goals. In this article, we will break down the tax benefits of both plans to give you a clear understanding, especially for the year 2025.

What is a 401(k)?

A 401(k) is a retirement savings account that many employers offer. The goal of a 401(k) is to allow employees to save money for retirement while benefiting from tax advantages. The money you contribute to a 401(k) plan comes from your paycheck before taxes are taken out, which can lower your taxable income in the year you contribute.

In 2025, there are two main types of 401(k) plans to choose from: the Roth 401(k) and the Traditional 401(k). Both offer tax benefits, but they work in different ways.

Roth 401(k) vs. Traditional 401(k): How Do They Work?

Both the Roth 401(k) and Traditional 401(k) are employer-sponsored retirement plans, but the way they treat taxes is different.

Traditional 401(k) Tax Benefits

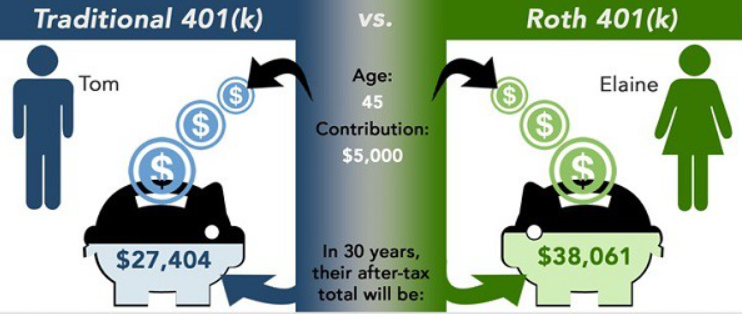

A Traditional 401(k) allows you to contribute money to your account before paying taxes on it. This means that if you make $50,000 a year and contribute $5,000 to your Traditional 401(k), your taxable income for the year will be $45,000. By reducing your taxable income, you pay less in income taxes for that year.

However, when you withdraw the money in retirement, you will have to pay taxes on the amount you take out. This means that even though you get a tax break today, you will be taxed later when you retire and begin using the money.

For example, if you withdraw $5,000 from your Traditional 401(k) after retiring, that amount will be taxed as ordinary income. The tax rate will depend on your tax bracket at that time.

Roth 401(k) Tax Benefits

The Roth 401(k) works differently. With a Roth 401(k), you pay taxes on the money you contribute now, but the withdrawals you make during retirement are tax-free. This means that if you put $5,000 into a Roth 401(k) in 2025, that $5,000 will be taxed as part of your current income. However, once you retire and begin withdrawing the money, you won’t have to pay any taxes on it.

This tax-free withdrawal benefit is one of the key reasons people choose the Roth 401(k). If you believe your tax rate will be higher in retirement, a Roth 401(k) may help you avoid paying more taxes later on.

Which One is Right for You: Roth 401(k) vs. Traditional 401(k)?

When deciding between a Roth 401(k) and a Traditional 401(k), there are a few factors to consider. Understanding how each option affects your taxes in 2025 and beyond can help you make an informed decision.

1. Current vs. Future Tax Rates

One of the main differences between the Roth 401(k) and the Traditional 401(k) is when you pay taxes. If you expect your tax rate to be lower in retirement than it is now, a Traditional 401(k) might be a better option. Since you don’t pay taxes on the money you contribute today, you could take advantage of a lower tax rate in the future.

On the other hand, if you expect your tax rate to be higher in retirement, a Roth 401(k) could be the better choice. Paying taxes now while you’re in a lower tax bracket means that your withdrawals will be tax-free when you retire.

2. Flexibility in Withdrawals

Another factor to consider is how much flexibility you want when it comes to your withdrawals. Roth 401(k) plans offer more flexibility, as you can withdraw your contributions (but not the earnings) at any time without paying a penalty or taxes. However, Traditional 401(k) plans don’t offer this flexibility. Withdrawals before age 59½ typically result in both taxes and penalties.

3. Required Minimum Distributions (RMDs)

Both the Roth 401(k) and the Traditional 401(k) have Required Minimum Distributions (RMDs). These are mandatory withdrawals that you must start taking from your 401(k) once you reach age 73 (as of 2025). However, there is a key difference between the two accounts when it comes to RMDs.

While you will have to take RMDs from a Traditional 401(k) and pay taxes on those withdrawals, Roth 401(k)s require RMDs as well. But, unlike Traditional 401(k) withdrawals, Roth 401(k) withdrawals are tax-free. This means that even though you must take the money out, you won’t have to pay any taxes on it.

4. Contribution Limits

In 2025, the contribution limits for both the Roth 401(k) and Traditional 401(k) are the same. You can contribute up to $22,500 annually, or $30,000 if you are 50 or older. Whether you choose a Roth or Traditional 401(k), these contribution limits apply to both types of accounts.

What to Consider in 2025

As we move into 2025, it’s important to keep in mind some changes that may affect your decision between a Roth 401(k) and a Traditional 401(k).

1. Tax Rates in 2025

Tax rates may change in 2025, which could impact your decision. If tax rates rise, a Roth 401(k) might become even more attractive because you would pay taxes at today’s lower rates rather than at higher rates in retirement.

2. Investment Growth Potential

The money in both a Roth 401(k) and a Traditional 401(k) grows tax-deferred, meaning you won’t pay taxes on your investment earnings until you withdraw the funds. However, the big difference is that the Roth 401(k) allows for tax-free growth. The longer you leave your money in a Roth 401(k), the more you stand to benefit from tax-free growth, especially if your investments perform well.

3. Employer Match

Many employers offer matching contributions to your 401(k) plan. If your employer offers a match, this money will be contributed to your Traditional 401(k) even if you have a Roth 401(k). The employer’s contribution will still be taxed when you withdraw it, even though your Roth contributions are tax-free.

Conclusion: Roth 401(k) vs. Traditional 401(k) Tax Benefits in 2025

Choosing between a Roth 401(k) and a Traditional 401(k) comes down to your current tax situation, your expectations about taxes in the future, and your retirement goals. Both types of 401(k) accounts offer valuable tax benefits, but the timing of when you pay taxes and how you access your funds in retirement are important factors to consider.

In 2025, tax laws could change, and you might want to reevaluate your decision based on the current tax rates and how they align with your financial goals. Whether you choose a Roth 401(k) or a Traditional 401(k), the most important thing is that you start saving for retirement and take advantage of the tax benefits each plan offers.