Tax wise Quality of earnings

we’ve bought businesses and guided hundreds from LOI to closing.

"I have purchased two companies, and have helped 100's of others do the same"

Unlike our competitors, we’ve actually bought businesses and helped hundreds of buyers from LOI to closing. Numbers alone aren’t enough when making an acquisition—you need someone who has been through the process, understands due diligence, and knows what to look for beyond just spreadsheets. A great CPA can analyze financials, but buying a business takes more than that—it requires hands-on experience, knowing what red flags to spot, and ensuring you don’t overpay or miss hidden risks.

Zachary Jensen, managing partner and head of QOE due diligence.

QoE is More Than Just Financials—It’s About Risk & Readiness

A Quality of Earnings (QoE) report is designed to give you peace of mind, ensuring that the business you’re buying is exactly what you think it is. While financial statements provide a snapshot of the numbers, they only tell part of the story. A QoE digs deeper, uncovering hidden risks, non-recurring revenue, aggressive accounting practices, and cash flow realities that can significantly impact a business’s true profitability. Without this level of due diligence, you could be walking into a deal with unrealistic expectations, overpaying for a business that doesn’t perform as advertised, or missing financial red flags that could put your investment at risk.

What sets us apart is our ability to go beyond the numbers and provide a level of in-depth due diligence that ensures you’re making the right decision. We don’t just check spreadsheets—we ask the hard questions, analyze key trends, and uncover anything that could impact your future earnings. Whether it’s verifying the sustainability of revenue, identifying operational weaknesses, or ensuring the financials match reality, we go the extra mile for buyers. When you work with us, you’re not just getting a report—you’re getting a team that is invested in your success, making sure that the business you’re buying is exactly what you expect it to be.

What is a QOE report?

Why is a QOE worth it?

Why do i need a QOE if the sellers financials are audited?

Whats included in a Regular QOE?

These are the services you will find in most QOE's on the market

☑️ Revenue Sustainability & Customer Concentration – Identifies whether revenue is stable, dependent on a few key customers, or at risk due to potential churn.

☑️ EBITDA Adjustments (Non-Recurring, Normalizing, and Accounting Adjustments) – Adjusts reported earnings by removing one-time events, aligning costs with current conditions, and correcting accounting inconsistencies.

☑️ Working Capital Analysis – Evaluates whether the business has enough liquidity to maintain operations and fund growth post-acquisition.

☑️ Revenue Recognition Practices – Assesses whether revenue is recorded on a cash or accrual basis and ensures proper alignment with accounting standards.

☑️ Debt & Liabilities Review – Identifies outstanding debts, contingent liabilities, and financial obligations that could impact the business post-closing.

☑️ Cost Structure & Expense Analysis – Analyzes operating costs, discretionary expenses, and areas where profitability might be overstated or understated.

☑️ Inventory & Asset Valuation Adjustments – Ensures assets are properly valued, identifies obsolete inventory, and verifies whether tangible assets align with reported book values.

☑️ Profitability & Margin Trends – Evaluates how gross and net margins have changed over time, ensuring long-term financial stability.

☑️ Cash Flow & Earnings Quality – Determines whether reported profits are backed by actual cash flow or if earnings rely on non-cash or non-recurring income sources.

Whats included in a Tax wise QOE?

We will go the extra mile to ensure your acquisition is as de-risked as possible

✅ All of the above services PLUS:

✅ In-Depth Seller Interview – We conduct a comprehensive interview with the seller and key employees, diving deep into operations, financials, and risk factors. Additionally, we verify their responses through independent due diligence to ensure accuracy and identify any potential red flags.

✅ Due Diligence Audit – We review all due diligence questions you’ve asked so far, assess their effectiveness, and identify critical missing questions that should be addressed. This ensures you have a complete and thorough understanding of the business before finalizing the deal.

✅ True After-Tax SDE Calculation – Beyond just projecting future Seller’s Discretionary Earnings (SDE), we calculate what your actual after-tax income could look like in the first year post-acquisition. This provides a realistic view of your take-home pay and helps you plan for tax obligations upfront.

✅ Competitor Analysis & Market Positioning – We evaluate your competitors, identifying what they are doing that your target business is not. This analysis highlights profit-boosting opportunities, allowing you to make strategic improvements from day one to increase revenue and market competitiveness.

✅ Forward-Looking Cash Flow Forecast – We go beyond historical financials to project your future cash flow post-acquisition, factoring in operating costs, debt service, tax obligations, and expected revenue trends. This ensures you have a clear financial roadmap and can anticipate potential cash flow challenges before they arise.

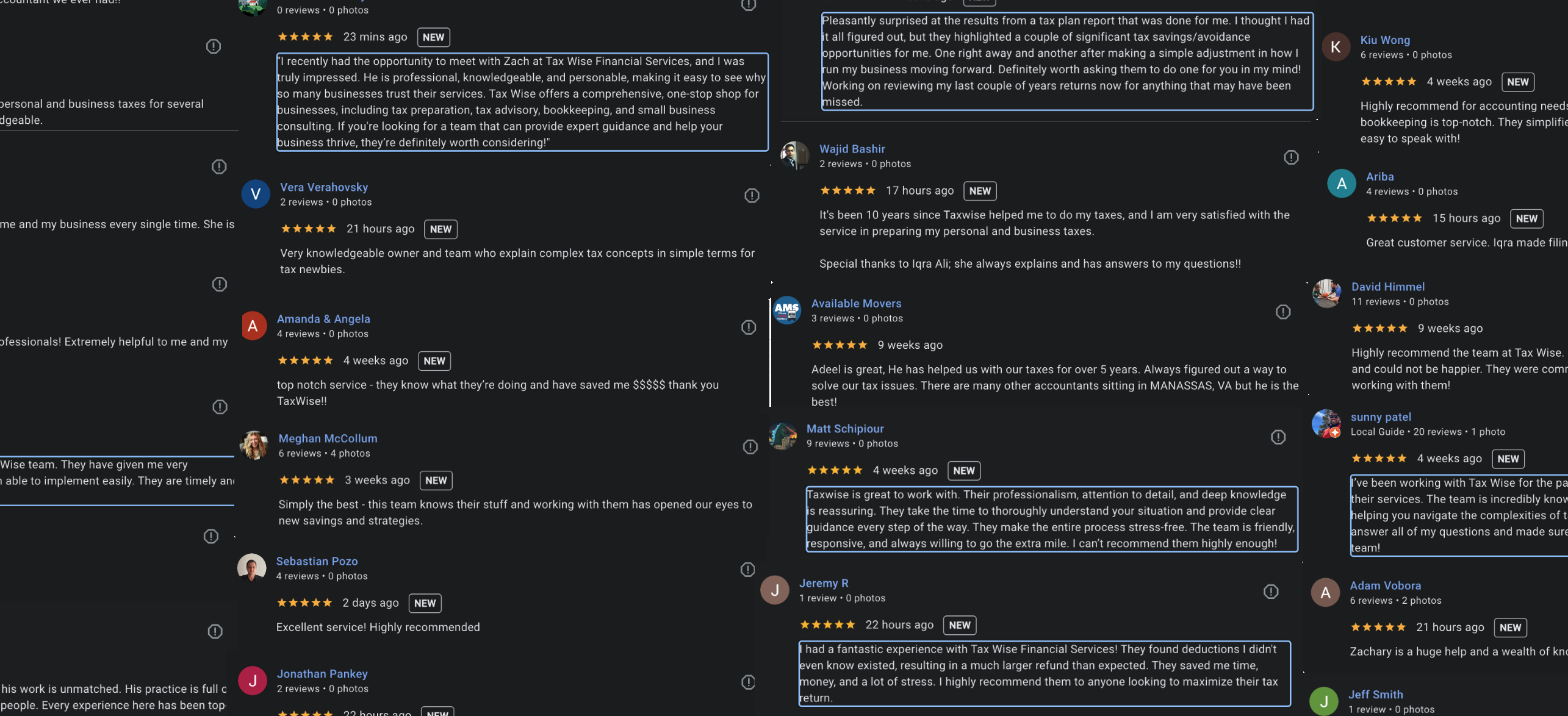

Over 100+ 5 star reviews