Page 1: Understanding the Basics

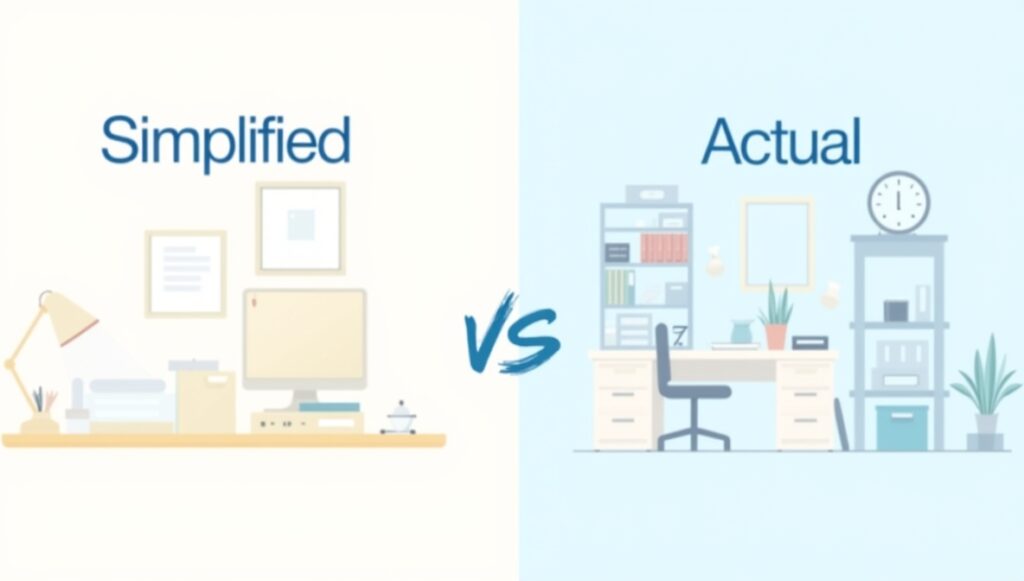

If you work from home, you may be able to save money on your taxes. But how do you choose the best way to do it? Many people ask, “Home office deduction: simplified vs actual method”—and the answer depends on your situation. This article will help you understand both options clearly.

The simplified method is easy. You multiply the square footage of your home office (up to 300 square feet) by $5. That means the most you can deduct is $1,500. There is no need to keep receipts or track bills. It saves time.

The actual expense method takes more work. You need to keep records of all home-related expenses like rent, mortgage interest, utilities, repairs, and insurance. Then, you figure out what percent of your home is used for work. You apply that percent to the total costs. You might get a bigger deduction, but it takes effort.

Page 2: Pros and Cons of Each Method

When comparing the home office deduction: simplified vs actual method, it’s important to look at the pros and cons.

The simplified method is great for small spaces and people who don’t want to track costs. It’s fast, easy, and lowers the chance of mistakes. But if you have high home costs or a big office space, you may miss out on a bigger tax break.

The actual expense method might help you deduct more money if your costs are high. But it takes time to track everything. You also need to be very careful. If the IRS audits you, you will need proof of every cost.

Also, to claim either method, your home office must be used only for business. You can’t deduct space that is also used for your bed, couch, or kitchen.

Page 3: Choosing the Best Option in 2025

In 2025, many people still work from home. Whether you’re self-employed or a freelancer, choosing the right deduction method can make a big difference. So, when it comes to the home office deduction: simplified vs actual method, the IRS lets you pick each year. Be sure to check your numbers before filing.

Use the simplified method if:

- You want to save time

- Your office is small

- Your home costs are low

Use the actual method if:

- You have high housing costs

- Your office is large

- You like tracking your expenses

You can even try both methods and see which gives you the biggest deduction. Just make sure to follow the rules. Use your space only for work and keep your records neat.

To wrap up, the question of home office deduction: simplified vs actual method is one that depends on your needs. With a little time and planning, you can choose the option that saves you the most money in 2025.